Picture Credit: JenkoAtaman

Choosing the right financial account for your child’s future can be daunting. With so many options available, finding an account that suits your child’s needs and goals is important.

Whether you want to save for their future education needs or help them save for a new car or home, the YoorKids app can assist you in achieving these goals. Once you open an account to benefit your child, YoorKids makes it easy to start growing contributions from friends and family. But which type of financial accounts can you connect in the YoorKids app?

Read more about YoorKids and how it is revolutionising the gifting concept.

Child Financial Account Options

Let’s take a closer look at some of the different types of accounts that can be used with the YoorKids app.

Savings Account

A savings account is a common choice for parents looking to save money for their child’s future. It offers a safe and secure way to grow funds over time.

529 Plan

A 529 Plan, on the other hand, is specifically designed for education expenses. Investing in a 529 Plan ensures that your child has the financial resources they need to pursue higher education.

Custodial

Custodial accounts are another option, allowing parents to manage funds on their children’s behalf until adulthood. Whatever account(s) you choose, DuckBank is here to help grow contributions.

Connecting Accounts in the App

Linking your financial accounts to the YoorKids app is a simple process for parents. After setting up a parent account in the app, you can create profiles for each child to receive contributions.

From there, you’ll need to connect a financial account(s) to each child’s profile. This requires providing basic information, such as the child’s name, email address, the financial institution’s routing number, and the account number. Here’s the great thing: any account that benefits a child and has both an account and routing number can be connected! This is a huge relief for parents with a bank or financial planner they already like working with.

YoorKids can connect to almost any type of financial account!

YoorKids is Unique

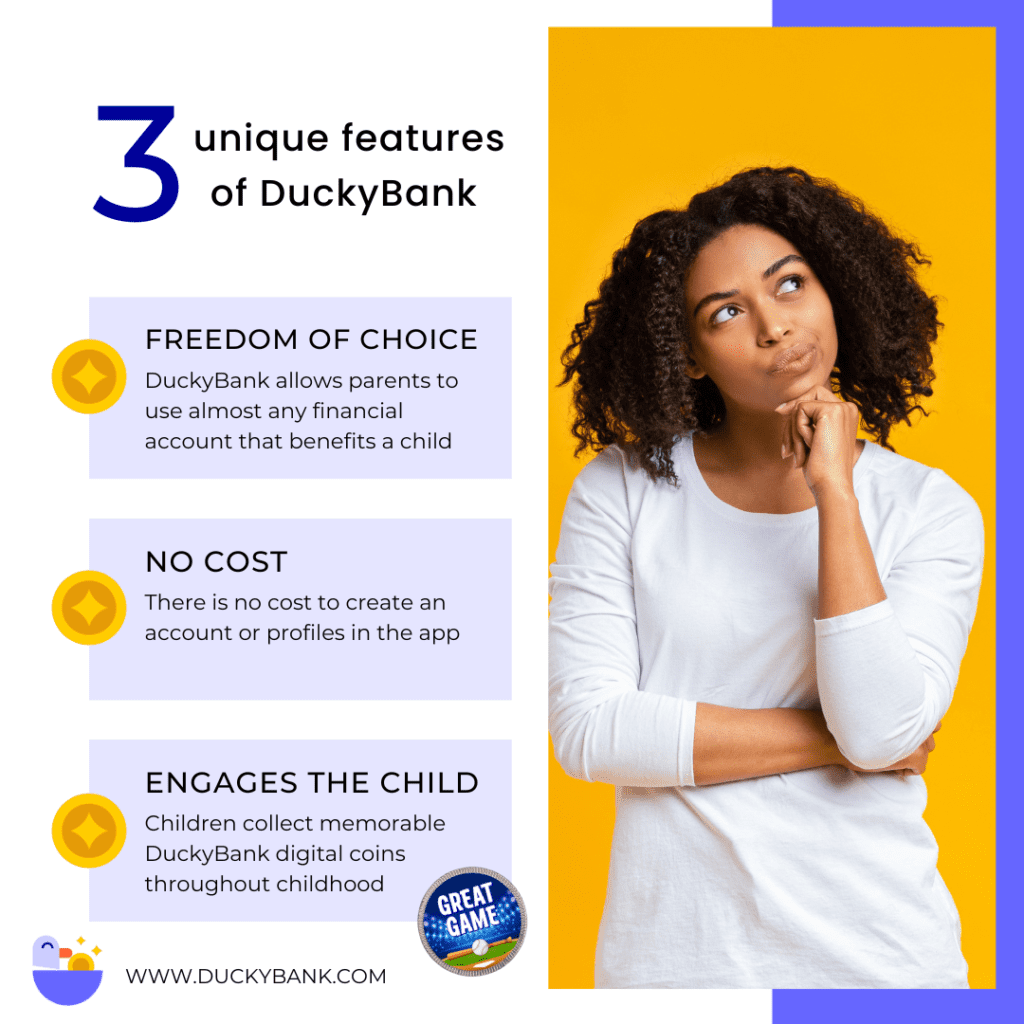

What sets the YoorKids app apart from other child investment apps is its unique features.

- Power to Choose

- We give parents the power to choose. We accept any financial account that benefits a child, meaning you can work with the financial institution of your choice. This flexibility allows you to make decisions based on your preferences and needs. So if you already have accounts you have been contributing to, set them up in the app and start receiving more contributions for your child.

- No Cost

- Another standout feature of the YoorKids app is that it’s free to start. No costs are associated with setting up a child’s profile or receiving money. You won’t have to worry about monthly maintenance fees eating into your savings.

- Plus, your child will never be charged a fee, either. The only cost involved is a small fee the gift giver pays when sending money through the app.

- Engaging

- One of the most engaging aspects of the YoorKids app is how it involves the child. Our personalized YoorKids coins make monetary contributions feel like gifts. When someone sends money to your child’s profile, they can create a digital coin with custom graphics, photos, videos, and more.

- These coins are then delivered to the child’s profile, where they can collect them and watch their savings grow. It’s a fun and interactive way to teach children about the value of money and the importance of saving.

Set Your Child Up For Success Today

The YoorKids app provides a smart way to secure your child’s financial future. You can use almost any child bank account with it, whether opening a new one or integrating an existing one.

The power of choice is in your hands! With YoorKids, you manage your child’s financial path and prepare them for success. Don’t delay—begin boosting your child’s savings now with YoorKids!